April 2024

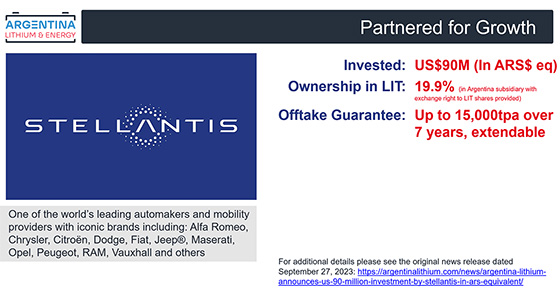

Argentina Lithium surges forward with US$90 million investment in ARS$ equivalent from auto maker Stellantis.

Stellantis is acquiring 19.9% of Argentina Lithium & Energy Corp.'s Argentine subsidiary, having invested the equivalent of US$90 million in local currency. They have the right to convert this interest into a 19.9% interest in the parent company in the future.

The companies have also entered into a lithium offtake agreement in the event Argentina Lithium achieves commercial production.

It's clear that Stellantis finds value in Argentina Lithium (LIT.V; PNXLF.OTC) that the market has overlooked. They spent the equivalent of US$90 mm in Argentine pesos to acquire 19.9% of its Argentine subsidiary.

Prior to the auto manufacturer's investment, LIT had a total market value of just US$21 million. There's a larger story here – including a stack of near-term catalysts.

In this report, we take Argentina Lithium & Energy Corp. apart piece by piece to get a feel for what Stellantis sees in the company and its projects.

About Stellantis NV

According to Wikipedia, Stellantis (NYSE: STLA, www.stellantis.com, ~$57 billion market cap) is the 4th-largest car manufacturer globally, based on 2022 sales, behind Toyota, VW and Hyundai. It is larger than Tesla, Ford and GM.

The company was built on mergers and acquisitions: It is the 4th-largest worldwide, yet it did not exist ten years ago. In 2014, Fiat completed the acquisition of Chrysler and formed Fiat-Chrysler Automobiles (FCA). In 2019, FCA started the process of merging with Peugeot/Citroen of France (PSA).

The merger was completed in January 2021, and the name was changed to Stellantis N.V. The company is based in Amsterdam and headed by CEO Carlos Tavares who had earlier served as the president of Peugeot/Citroen.

Unique among the major auto makers

Stellantis is distinct. It is the globally diversified auto maker. It controls 16 brands of cars and trucks. In the US, there's Jeep, Dodge, Chrysler, Ram trucks and Mopar auto parts. Based in France, there's Citroen, Peugeot and DS Automobiles. Based in Italy, there's Fiat, Fiat Professional, Alfa Romeo, Lancia, Abarth and Maserati. In the UK, there's Vauxhall. Based in Germany is Opel.

According to their website, the company has 272,000 employees, sales in 130 countries and manufacturing facilities in 30 countries. In 2021, CEO Tavares issued a challenge to all 16 divisions – which operate independently – to prove themselves over the coming ten years in exchange for capital and technology.

Importantly, the group targets producing and selling more than 75 battery electric vehicle models based on four EV platforms which are addressed and shown on their website as part of the company's global plan called Dare Forward 2030.

This demonstrates a serious future requirement for lithium and lithium-ion batteries.

How Stellantis is performing

Over the past year, through the end of September 2023, the share price is up +50%. For a comparative, the S&P 500 is up 16% over the same period.

Net revenues for the first six months of 2023 were 98.4 billion euros (US$104 bn), up 12%. Net profit over the same six-month period was 10.9 billion euros ($11.55 bn), up 37% compared to the year earlier.

In announcing the investment in Argentina Lithium on October 6, Stellantis stated the following, "This acquisition represents an important step for Stellantis in the sustainable mobility strategy and the importance of South America in the company's global plan."

Argentina Lithium – loaded with near-term catalysts

To read the company's news release that announced the investment by Stellantis, link through here.

The company, at www.argentinalithium.com, controls four good-sized lithium brine project areas in the Lithium Triangle in far northwestern Argentina.

We will know a lot more about LIT very soon. It is well positioned to make substantial progress during the remainder of this year and into next year.

We will focus here on Argentina Lithium's discovery at the Rincon salar adjoining the large and active position held there by Rio Tinto Plc (RIO.NYSE, www.riotinto.com) plus LIT's plans for near-term exploration adjoining Albemarle Corp. (NYSE: ALB, www.albemarle.com) at the Antofalla salar.

Rincon salar – two near-term lithium producers

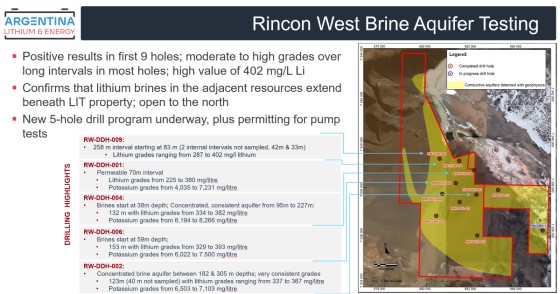

First, the company is actively exploring to expand their discovery at the Rincon salar, adjacent to the west, north and east of Rio Tinto.

The company controls over 5,000 hectares at the Rincon salar (more than 7km by 7km) with the majority lying adjacent to the west side of the Rio Tinto concessions, and additional parcels adjacent to the north and east of Rio Tinto.

All nine drill holes by Argentina Lithium at Rincon West in the recent campaign sampled lithium-enriched brines. Drilling focused on the central part of the property where excellent brine grades – similar to those reported in the past for Rio Tinto's Rincon property (Montgomery & Associates, July 26, 2021, the last resource estimate before Rio's acquisition) – were returned over broad intervals in the majority of holes.

Please note that proximity to other mining projects does not provide any assurance with respect to making similar discoveries.

Prospective expansion at Rincon West

Argentina Lithium has begun the modelling work for a potential future resource estimate for this first area based on these positive results. Additionally, the company has drilled the first of five planned holes on the adjacent Rinconcita II block on the east side of Rincon West. Hole #2 from the initial nine holes, one of the best holes drilled, lies directly adjacent to the west border of Rinconcita II.

The company plans to then expand its exploration focus to the company's third property in the Rincon Salar, the Paso de Sico block lying adjacent to Rio Tinto on the north. Permitting is underway here, with a plan to execute at least six drill holes.

Rio Tinto does not do small projects

Rio Tinto is the world's second largest mining company as measured by market capitalization. Rio controls the core of the Rincon salar. It is their largest and most advanced lithium project globally.

The Rincon salar is an exciting basin to follow because both Rio Tinto and one of the three juniors there – Argosy Minerals Ltd. – are expected to initiate production in the near term.

Rio Tinto acquired their Rincon salar project in March 2021 from Rincon Mining for $825 million. The company has been very active at the salar since making the acquisition.

According to miningweekly.com, Rio Tinto has constructed and is operating a pilot plant on site. It is aggressively drilling to expand the resource and has started construction of a 3,000-tonne/year starter plant to produce lithium carbonate commencing in 2024. Its plan is to have the starter plant serve as a pilot for a much larger, 50,000-tonne/year plant there, a substantial enterprise.

Rio Tinto also announced in July 2022 that it has signed a Memorandum of Understanding with Ford Motor Company for delivery of lithium carbonate from the Rincon salar. Additional information is available at www.riotinto.com/en/operations/projects/rincon.

Second near-term producer at the Rincon salar: Argosy Minerals Ltd.

Argosy Minerals Limited (ASX:AGY, www.argosyminerals.com.au), an Australian public junior, controls concessions in the southeast area of the salar. On November 17 this year, the company announced it has produced 48 tonnes of battery-grade lithium carbonate thus far on site at the Rincon salar.

The company initiated continuous operations on a trial basis as of the end of June. It is targeting an increase of production in Q1, 2024, with a goal of producing at the rate of 2,000 tonnes/year of battery-grade lithium carbonate later in the year.

Argosy has completed a second round of exploration drilling totaling six holes, which have added brine-bearing thickness beneath the current resource. It has completed two pumping wells and is targeting an updated resource estimate by the end of this year with an updated Feasibility Study planned in 2024 – while gradually expanding lithium carbonate production on-site.

By achieving production and sales of lithium carbonate at the rate of 2,000 tonnes/year, Argosy is targeting earning the capital to partially fund increasing production to 10,000 tonnes/year. In the same November 17 news release, the company reported that it is making progress with strategic arrangements for off-take and capital funding for the 10,000 t/year level.

A fourth company now exploring at the Rincon salar

Power Minerals Limited (ASX: PNN, www.powerminerals.com.au), a small Australian public company, recently acquired a concession in the far southwest area of the Rincon salar, south of Argentina Lithium.

As stated in a news release dated November 29 this year, the company has completed three drill holes. With results from these three holes – each separated by 2 – 4 kms – plus two holes drilled by a different company in 2017, management has had consultants draw together an initial Preliminary Economic Assessment, which they state to be positive, based on a JORC 2012 mineral resource of 292,564t (as announced November 2, 2023).

Summary of the status of the Rincon salar

As stated, four companies are aggressively exploring and developing lithium assets at the Rincon salar in northwestern Argentina. Two are targeting initial near-term production, including the world's second-largest mining company with its most advanced lithium project.

Argentina Lithium is working toward generating its first lithium brine resource estimate at Rincon. It has completed its first successful drilling program of nine holes at the project. The company has initiated its second drilling campaign of five holes at the adjoining concession on the east side. Now, with substantial additional funds, the company is positioned to significantly expand and speed up its exploration output here.

Argentina Lithium, Albemarle Corp. and the Antofalla Salar

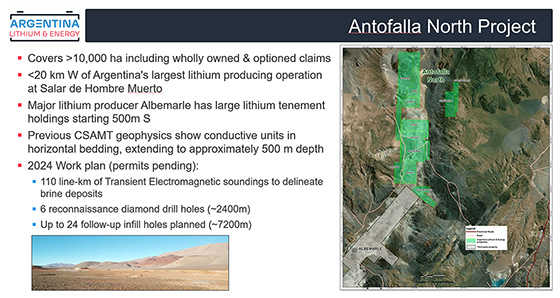

The Antofalla salar is north-south oriented, approximately 160 km long, and is located 20 km (12 miles) west of the Hombre Muerto salar, currently Argentina's largest lithium-producing area.

The Antofalla Project, in the Antofalla salar, is controlled by Albemarle Corp., the world's second-largest lithium producer. Albemarle stated publicly that the company controls one of the largest lithium resources in Argentina at Antofalla in their news release dated September 12, 2016.

Here, Argentina Lithium controls Antofalla North, covering the northern extension of the salar basin adjoining Albemarle's project. The claims cover over 10,000 hectares, (more than to 10 km. by 10km., a substantial area. Antofalla North is anticipated to be permitted for exploration programs in the near term.

The company's plan when permitted is to initiate geophysical surveys in anticipation of first drilling, if merited. With the recent investment from Stellantis, management has stated that they intend to make rapid progress at Antofalla.

Additional concessions

Argentina Lithium also controls extensive mineral rights at the Pocitos salar – covering approximately 20% of the basin, located south of Rincon – and the Incahuasi salar in Catamarca province, covering approximately 90% of the salar. The Incahuasi salar lies in the valley adjacent to Lake Resources N.L.'s (www.lakeresources.com.au) Kachi development project.

(Please note that there are two Incahuasi salars, one in Salta province and one in Catamarca province, which is the one controlled by LIT.)

Both the Pocitos and Incahuasi projects have the potential for hosting lithium brine resources. Several other companies are exploring the Pocitos salar now. Here the company is permitted for exploration and has initiated a large geophysical survey program.

The Incahuasi salar in Catamarca has no exploration from others to use as a guide since LIT, practically speaking, controls the entire salar. LIT has carried out some initial geophysical and surface geochemical work and limited drilling at Incahuasi (August 24, 2018 news release), and plans an additional geophysical survey in 2024.

Management at Argentina Lithium has advantages

Argentina Lithium has a distinct advantage over other explorers in Argentina. The company is a member of the Grosso Group, which has been actively exploring in Argentina for 30 years, since mineral exploration started there in 1993.

Companies managed by the Grosso Group share operational resources, providing outsized ability to acquire and manage projects by deploying an expert team.

The Grosso Group has been involved in four major mineral discoveries in Argentina thus far. CEO Nikolaos Cacos and VP-Exploration Miles Rideout are unrelenting in the pursuit of additional discoveries and expansion.

Joseph Grosso,

Director

President & Founder of the Grosso Group management company & pioneer of exploration in Argentina since 1993.

Nikolaos Cacos,

President and CEO, Director

+30 years of management expertise in the mineral exploration industry: extensive experience in strategic planning & administration of public companies.

Miles Rideout,

VP of Exploration

34 years of experience in advanced exploration practice, responsible business management, scientific team building, and mining integration with local communities and indigenous peoples.

Stellantis and Argentina Lithium

With the Argentine equivalent of US$90 million added to the company's coffers, Argentina Lithium is super-charged. Before the Stellantis funding, LIT was already well into a systematic exploration program at its Rincon West project, next to Rio Tinto. Exploration permits are anticipated for the Antofalla North project as well.

Now, with the added funds and relationships, this company holds the potential to really deliver.

As one example that Stellantis and Argentina Lithium could be well positioned, respected Benchmark Minerals Intelligence stated in an article on August 4 this year, shown here, that investment of $116 billion is needed in the lithium industry to meet automaker and government policy targets by 2030. They state further that just to meet base case demand for lithium in 2030, that is, their lowest projected usage, will require $54 billion to be invested in the sector.

For full information and to register for breaking news, link through here: www.argentinalithium.com. Or call Shawn Perger, IR, at 604-687-1828 to speak to a knowledgeable person.

© 2023, All Rights Reserved. Natural Resource Investor is a client-sponsored publication. Argentina Lithium & Energy Corp. pays monthly fees to an associated company. Safe harbor provisions apply as per the company's website.