Bullfrog Gold Corp.

(OTCQB: BFGC) |

September 13, 2016 |

Finding Gold in Nevada by Looking

Where It's Been Mined Before

Bullfrog Gold Corp. Compiles 470,000 oz. Gold Inventory Left Behind by Barrick's Bullfrog Subsidiary

This report will introduce

you to Bullfrog Gold Corp. (OTCQB: BFGC), a gold exploration and

development company started in 2011 with a gold project that is 120

miles NW of Las Vegas, Nevada. The company is dedicated to proving the

maxim that if you want to find gold, the best place to look is where it

has previously been found.

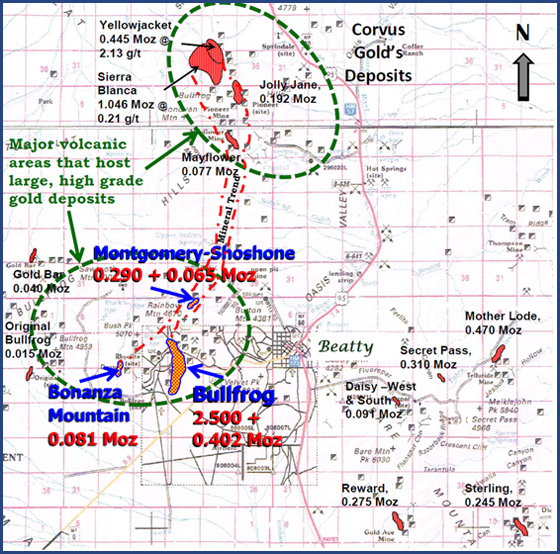

Located within the prolific

Walker Lane Mineral Trend and only 4 miles west of the town of Beatty,

Nevada, this gold mining area produced 2.3 million oz gold averaging

0.08 oz/t for Barrick Gold. Here, Barrick, et al, conducted major mining

operations between 1989 and 1999.

Barrick's mines included

the major Bullfrog pit (1.1 mil.oz @ 2.5 g/t gold), the underground

Bullfrog mine (690,000 oz. gold @ 7.5 g/t), and the Montgomery-Shoshone

pit (M-S) which yielded 220,000 oz gold @ 2.2 g/t gold. (See area maps

below.)

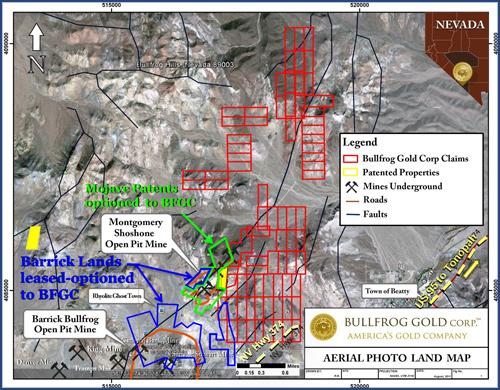

Our own company, Bullfrog

Gold Corp, began exploring this area in 2011 with the acquisition of its

initial land position of 79 claims and two patents located immediately

east and north of the Bullfrog and M-S open pit mines. Subsequently, the

company optioned from another land owner 12 additional land patents

that were previously leased by Barrick. These patents cover the NE half

of the M-S pit and significant exploration areas north and south of the

M-S pit. The company also leased and optioned from Barrick 28 claims and

6 more patents, two cover the SW half of the M-S pit and the balance of

lands cover the northern third of the original Bullfrog deposit. Today,

the company controls the entirety of the M-S, the northern third of the

Bullfrog pit and all the area underground mined by Barrick, plus

prospective lands to the east and north.

Gold Deposits in the Beatty Area

(M-S and Bullfrog includes Barrick + BFGC Estimates)

In all, the company now

holds 2,200 acres here, including 99 federal lode claims, 20 patented

claims and 8 mill site claims. Additionally, the company has identified

significant additional mineralization and further exploration potential

which has been based on an intensive study of Barrick's electronic and

paper data bases. This data includes 157 miles of drilling in 1,298

drill holes, as well as more than 2,500 pounds of paper documents.

Today, all this data would cost more than $40 million to re-create. This

study yields some surprising results in terms of showing strong

potential for additional gold content throughout this area.

It is noted that Bullfrog

Gold is the only one to examine the electronic and paper data bases

after they were shipped offsite in 2000; and is the only entity to

thoroughly evaluate the mineralization remaining around and under

Barrick's Bullfrog and M-S pits and between the Bullfrog pit and

underground mine.

Current Gold Inventory Estimated at 470,000 oz. Gold

The Company has analyzed

and estimated the remaining mineral inventories of gold around the

Montgomery-Shoshone and Bullfrog mines at 470,000 oz. gold as summarized

below:

| Mineral Inventory Estimates: |

| Pit Areas |

Tonnes Millions |

Gold G/T |

Gold Ounces |

| M-S Shallow |

1.1 |

1.06 |

38,612 |

| M-S Deeper |

0.9 |

0.93 |

26,813 |

| Bullfrog North |

13.3 |

0.88 |

375,051 |

| BF NE Mystery Hill |

0.9 |

0.80 |

26,813 |

| |

| Total/Average |

16.4 |

0.89 |

469,961 |

|

The estimated mineral

inventory was calculated by the company at an average of 0.89 g/t using

manual cross-sectional methods and a nominal cut-off grade of 0.3 g/t.

This cut-off grade is higher than most heap-leach projects now operating

in the USA, suggesting that this area can be re-opened for productive,

low-cost heap-leach processing. The above estimates are strongly

supported by the close-spaced Barrick drill holes where 2.3 million oz

gold were recovered.

The company believes the

mineral inventory estimates can be readily and inexpensively upgraded

with minor additional drilling to comply with US and Canadian estimation

standards, as well as defining several additional exploration targets

which can expand overall gold mineralization in the area.

M-S Pit Area:

In addition to

mineralization immediately around the M-S pit, there is only one hole

located within 150 meters from the NE pit limit and the next hole is

1,000 meters NE. Furthermore, these mineral trends and structures have

been projected more than 4 km NE of the M-S pit, but only eight holes

were drilled by Barrick in this large area.

Located east of the M-S pit

area is an area that is 700 meters by 1,300 meters, but it contains

only one shallow old hole from which no data is available. Only a

portion of this area may be prospective, but additional study and

exploration drilling is warranted. The adjacent lands east and north of

this area also have limited drilling. The company now controls all the

lands that cover the M-S pit.

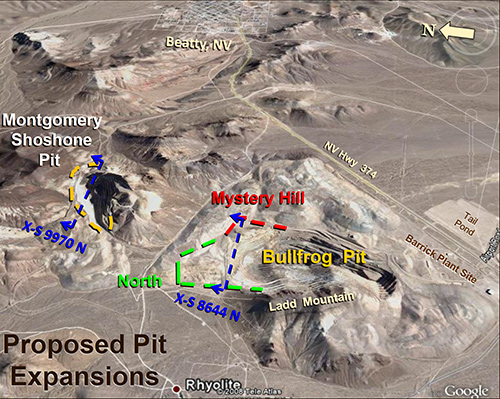

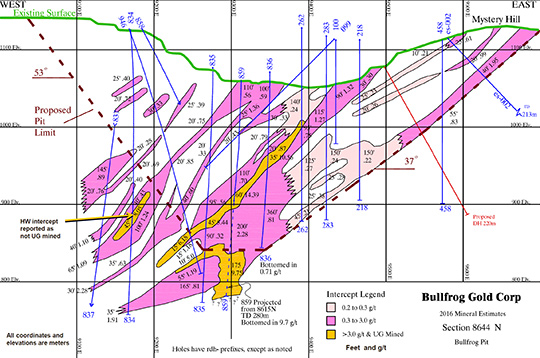

Bullfrog Pit and Underground Mine Area:

From 1989 through 1994

Barrick recovered more than 1,346,000 ounces by conventional milling of

Bullfrog ores using a pit cut-off grade of 0.5 g/t. From 1992 through

1998 approximately 690,000 ounces averaging 0.24 opt were recovered from

the north extension of the deposit and below much of the Bullfrog pit

using underground mining and a cut-off grade of 3 g/t. As a result,

significant mineralization grading from 0.2 to 3.0 g/t remains between

the pit and underground workings and in isolated high-grade intercepts

that were too small or distant to develop and mine underground. Since

Barrick's underground operations extracted 95% of their reserve, it is

expected that an additional 5% or 34,000 ounces averaging 0.24 opt

remain around the underground workings that are not included in the

company's estimates. Half of this high grade may be within pit mining

depths. Most of Barrick's Bullfrog production was from lands now

controlled by the company.

The Mystery Hill structure

is northeast and adjacent to the main Bullfrog deposit and has shallow

mineralization for a known strike length of 300 meters. This area only

contains 6 interior drill holes and has not been adequately drilled to

estimate deeper potential down-dip or expanding mineralization along

strike.

Metallurgy:

Heap-leach tests by Barrick

and others show very good gold recoveries. Pilot heap-leach tests

performed by Barrick in 1995 on 844 tons crushed to 1/2-inch size

averaged 0.019 gold opt and recovered 67% of the gold in only 41 days

while cyanide and lime consumptions were exceptionally low. Finer

crushed materials yielded gold recoveries up to 75%. Barrick did not

have lower cost heap-leaching facilities and used cut-off grades of 0.5

g/t for pit ore and 3.0 g/t for underground ore.

In 1986, St. Joe Minerals

column-leached a 22-ton composite of minus 12-inch material grading

0.037 gold opt to simulate heap leaching material at a coarse

run-of-mine size and recovered 49% in 59 days of leaching, which they

projected to 54% for leaching 90 days. As a result, much additional gold

could be recovered by run-of-mine heap leaching mineralization less

than 0.3 gram per tonne and thereby further increase mineralization and

enhance project performance.

Excellent Infrastructure:

It should be mentioned that

project infrastructure and attributes include water rights to the

entire area including the Bullfrog and the M-S mines area, a

high-voltage electrical power line and substation site installed by

Barrick, as well as a nearby town less than 4 miles away that hosts a

population of 1,000 with associated amenities and services. A paved

state highway crosses the southern property boundary, plus suitable

access roads remain throughout much of the property. Pit ramps remain in

excellent condition. Pit walls are stable up to 53 degrees, thus the

ultimate amount of waste that must be removed with the resumption of

mining will be significantly less than pits that require flatter slopes.

It should be noted that

haulage ramps from the surface to the pit bottoms all remain in place

thereby allowing expansion of the M-S and Bullfrog pits while minimizing

costs, particularly up-front. Furthermore, nearly all waste produced

from the Bullfrog and M-S pits could be sequentially back-filled in the

large Bullfrog pit. This would significantly reduce waste haulage costs

while also avoiding additional large waste dumps which would have

associated environmental impacts and costs.

Strategic Land Acquisitions:

As reported above, the

company acquired three strategic land positions in the Bullfrog Mining

District which include the entire Montgomery-Shoshone deposit and the

northern one-third of the main Bullfrog deposit where Barrick mined

approximately 2.1 million ounces by open-pit and underground methods. In

addition to prospective adjacent lands, these acquisitions contain

significant remaining ounces of gold and provide the potential to expand

both deposits along strike and at depth.

Details of these acquisitions are as follows:

The initial holdings of 2

patents and 79 lode claims were purchased on September 29, 2011. The

Company issued 14.4 million shares of BFGC and granted a production

royalty of 3% NSR on the property plus an aggregate 3% NSR cap on any

acquired lands within one mile of the 2011 boundary. Thus, the original

owner would not receive any royalty on acquisitions having an NSR of 3%

or greater.

Twelve contiguous patents

that include the northeast half of the M-S pit were optioned to purchase

on October 29, 2014 from a private company based in Salt Lake City. The

seller was paid $16,000 plus 750,000 shares of Bullfrog common stock on

closing and, to earn a 100% interest, is scheduled to be paid $200,000

over nine years while performing no less than $100,000 of work per year

for five years on or within 1/2 mile of the 12 patents. The selling

company retained a sliding scale Net Smelter Return royalty ranging from

1% for gold prices below $1200/ounce and up to 4% for gold prices above

$3,200 per ounce. For reference, Barrick terminated a lease on these

patents after they ceased operations in late 1999.

Bullfrog's Lease with Barrick:

Bullfrog's lease and option

with Barrick was signed on March 23, 2015 and includes 6 patents (two

of which cover the southwest half of the M-S pit); 20 unpatented claims

that cover the northern one-third of the main Bullfrog deposit and 8

nearby mill site claims. Bullfrog has access to Barrick's substantial

data base within a 1.5 mile radius of the leased lands to further

advance its exploration and development plans and programs. The lease

and option also includes all Barrick's water rights appurtenant to the

property. To maintain the lease and option, Bullfrog must spend $1.5

million within five years on the Barrick properties and then pay Barrick

3.25 million shares of Bullfrog stock while providing a 2% gross

royalty on production from the Barrick properties.

Overriding royalties of 5%

gross proceeds are limited to three claims and two patents in the main

Bullfrog pit area. Barrick has retained a back-in right to reacquire a

51% interest in the Barrick properties, subject to definition of a

mineral resource on the Barrick properties meeting certain criteria, and

reimbursing Bullfrog in an amount equal to two and one half times

Bullfrog's expenditures on the Barrick properties.

For reference, Barrick

terminated all mining and milling operations in 1999 when gold prices

averaged less than $300 per ounce for the year and reached a low of

$258/oz. in August 1999. The company as a result is well positioned to

explore such opportunities for the expansion of its mineral inventory. A

patented claim on the east and north limits of the M-S pit is owned by

the company, but Barrick never controlled or had access to that patented

claim. The economic margins for heap leaching lower grades at current

gold prices near $1330/oz are deemed much better than in 1999.

A series of corporate

takeovers changed the land ownership of the area originally from St. Joe

Minerals to Bond Gold, to Lac Minerals, and eventually to Barrick, who

folded its tents in 1999. Modern production here started in 1989 and

recovered approx. 2.3 million oz. gold from a conventional,

9,000-tonne/day cyanidation mill mainly fed from open pit mining, but

significantly supplemented from mining underground ores that averaged

0.24 ounces gold per ton.

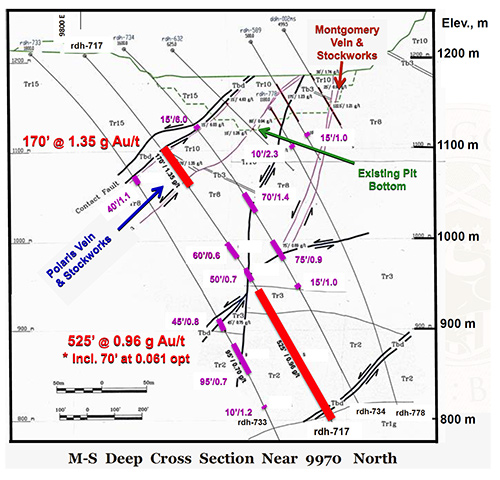

Beneath the M-S Pit:

Bullfrog management has

estimated that 38,612 ounces of gold in 1.1 million tons of material

averaging 1.06 grams per ton remains within the shallow zone under the

existing M-S pit. An additional 26,813 ounces of gold averaging 0.99

gram per tonne remain in the deeper zone under the M-S pit. These manual

estimates were based on cross sections typically spaced 15 meters

apart, a nominal cutoff grade of 0.3 gram gold per ton at the top and

bottom of mineral intervals, and drill data and pit surveys completed by

Barrick.

Half of this M-S

mineralization is on two Barrick patents within the pit and half is on

two of the 12 other patents. The ratio of waste to mineral tons within a

cross-sectional preliminary pit outline of the shallow estimate is

1.06:1 and the ratio for the overall estimate is 2.55:1. Additional

drilling is required to test further down dip extensions of

mineralization in the M-S area.

Significant drilling is

required to test projections of mineralized trends and structures that

extend for considerable distances to the north and east of the M-S pit

on the original lands acquired by Bullfrog in 2011. Located east of the

M-S pit is an area 700 meters by 1,300 meters in which there is only one

shallow hole from which there is no data available. Only a portion of

this area may be prospective, but it certainly warrants additional study

and exploration drilling.

There is only one drill

hole located about 150 meters NE of the M-S pit limit and another hole

1000 meters NE of the pit along strike of a major geologic structure. In

this regard, Bullfrog's lands extend nearly 5,000 meters NNE of the pit

and there has been very little drilling in this area, even though

several structures have been mapped by Barrick and others. This

situation suggests the potential for substantial additional gold

mineralization to be discovered in this area.

To Depth:

Barrick drilled twelve deep

holes in the M-S area, ranging from 318 meters to 549 meters deep, and

these also suggest the potential expansion of the mineral resources.

Notable mineral intercepts from four holes below the central part of the

pit are summarized below:

| Hole No. |

Intercept Data, Meters |

Gold G/T |

| Thickness |

Under Pit |

| 717 |

51.8 |

70 |

1.35 |

| 18.3 |

135 |

0.59 |

| 15.2 |

150 |

0.68 |

| *160.0 |

180 |

0.96 |

| 732 |

10.7 |

200 |

0.84 |

| 79.2 |

330 |

0.74 |

| 733 |

12.2 |

130 |

1.14 |

| 13.7 |

220 |

0.75 |

| 29.0 |

250 |

0.70 |

| 734 |

4.6 |

15 |

6.03 |

| 21.3 |

70 |

1.43 |

| 22.9 |

130 |

0.89 |

| 4.6 |

190 |

1.04 |

| |

| * 525 feet averaging 0.028 Au opt, includes 70 feet at 0.061 Au opt |

|

These

results demonstrate that substantial amounts of gold occur in this

exceptionally large epithermal system that has good potential for

expansion and possibly higher grades at depth. Note that four of these

intercepts are less than 75 meters below the existing pit. Two holes

located 40 meters and 90 meters east of the 160 meter interval in hole

#717 contained no significant mineralization at this depth, whereas the

29 meters of minerals in hole #733 is 60 meters west and the mineral

zone is open to the north, south and west.

In summary, Bullfrog Gold

looks forward to adding shareholder value through exploring its expanded

land position while building mutually beneficial business relationships

with Barrick and other stakeholders in the area.

Management & Geological Team for Bullfrog Gold

David Beling – President and CEO,

is a Professional Mining Engineer with 52 years of experience,

including engineering, permitting, financing and management of 12 open

pit mines, 9 underground mines, 14 process plants and building of

several corporations. His career initially included 14 years of

employment with Phelps Dodge, Union Oil, Fluor, United Technologies and

Westinghouse, then 38 years of project and executive management and

senior consulting with 25 junior US and Canadian base and precious metal

mining companies. During 2006 and 2007 he spearheaded an IPO, drove

three equity raises totaling C$ 112 million and grew the company's

market capitalization to US $460 million. Mr. Beling has served on

fourteen Boards since 1981, including three mining companies

distinguished by Canada's TSX Venture Exchange as top-10 performers.

Beling also has extensive heap leaching success and performance in

Nevada and drove the approval of the first Environmental Impact

Statement approved for a mine in Arizona.

Beling is the mastermind behind the expansion of Bullfrog Gold in the area described above.

Other Management

Alan Lindsay – Chairman.

40+ years of experience as a businessman, including 25 years in the

mining industry. Developer and founder of several public companies.

Tyler Minnick, CPA – Director Administration & Finance. 22 years of experience in accounting and auditing with public and private firms.

Clive Bailey, CPG – Lead Geological Consultant – Klondike Project. 42 years of experience with exploration, development and mine operations.

Joe Wilkins – Sr. Geological Advisor. 49 years of experience. Discovered 2.7 MM ounce Bullfrog deposit mined by Barrick.

Outlook for Bullfrog Gold

Bullfrog seems to be firmly

launched on the plan to upgrade its 470,000 oz. gold inventory to meet

and comply with US and Canadian resource standards. But there is also a

tremendous amount of exploration potential beyond this, as already noted

in this report. The company would not say so, but it is obvious that

there is a potential here for more than 1 million oz. gold. We look

forward to seeing the next leg of development here.

Bullfrog recently reduced

its debt from $3.0 million to less than $300,000. In summary, the

following table shows the company is significantly undervalued compared

to six peer companies, thereby providing an exceptional opportunity for

investment.

| Company & Project Comparisons |

| As of August 17, 2016 |

Exchange rate = C$ 1.286 |

|

| Company |

Project |

Meas.+Ind. Res. |

Mark. Cap

$ x MM |

Market Cap.

$ / Oz. M&I |

MT

x 1000 |

Oz. Gold

x 1000 |

| Corvus Gold |

North Bullfrog (1) |

28.8 |

628 |

82.0 |

130.57 |

| Pershing Gold |

Relief Canyon |

37.3 |

739 |

107.4 |

145.33 |

| West Kirkland |

Hasbrouck/3Hill |

65.1 |

927 |

36.1 |

38.94 |

| Northern Vertex |

Moss Mine |

15.5 |

377 |

32.7 |

86.74 |

| Otis Gold |

Kilgore |

27.3 |

520 |

24.2 |

46.54 |

| Waterton |

Mt. Hamilton (2) |

33.7 |

828 |

30.0 |

36.23 |

| |

| Averages |

35 |

670 |

30.0 |

77.73 |

| Bullfrog Gold |

Bullfrog (3) |

16.4 |

470 |

11.7 |

24.89 |

(1) Excludes 135 mm t of inferred resources at 0.2 g/t

(2) Mt. Hamilton sold in 2015 for $30 million before prices increased substantially

(3) Assumes mineralization is M & I. Excludes inferred and exploration potential |

|

We recommend that readers consider taking a position in Bullfrog Gold, which is traded on the OTCQB under the symbol of BFGC.

|